"Hard to say whether Saudi Arabia is following Venezuela's huge production drop, as both had notoriously overstated their reserves. The Saudi's conventional fields are very long in the tooth. Lets not forget MIT's - "Limits to Growth" - research book that predicted a major drop in resources around 2020, and so far their predictions have been fairly accurate, as evidenced by the graph below and the follow-up report 30 years later. It appears we are closing in on a new era - as cheap conventional oil runs dry. What's next is anybody's guess. "

Dr P G Kinesa

October 20, 2019

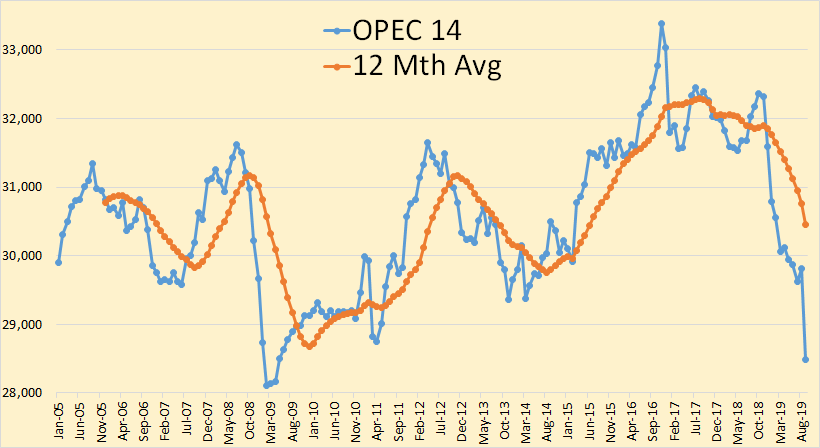

OPEC September 2019 Oil Production

Data for the OPEC charts below were taken from the October OPEC Monthly Oil Market Report

OPEC 14 crude oil production was down1,318,000 barrels per day in September. Most of that decline was due to the Iranian attack on the Saudi oil complex at Abqaiq. ( The question is whether this attack may have been staged to distract attention from the bigger production decline issue and overstated reserves?)

LIMITS TO GROWTH

KEY CONCLUSIONS

After reviewing their computer simulations, the research team came to the following conclusions:[1]:23–24

- Given business as usual, i.e., no changes to historical growth trends, the limits to growth on earth would become evident by 2072, leading to "sudden and uncontrollable decline in both population and industrial capacity". This includes the following:

- Global Industrial output per capita reaches a peak around 2008, followed by a rapid decline

- Global Food per capita reaches a peak around 2020, followed by a rapid decline

- Global Services per capita reaches a peak around 2020, followed by a rapid decline

- Global population reaches a peak in 2030, followed by a rapid decline

- Growth trends existing in 1972 could be altered so that sustainable ecological and economic stability could be achieved.

- The sooner the world's people start striving for the second outcome above, the better the chance of achieving it.

SYNOPSIS 30 YEAR UPDATE

The signs are everywhere around us:

- Sea level has risen 10–20 cm since 1900. Most non-polar glaciers are retreating, and the extent and thickness of Arctic sea ice is decreasing in summer.

- In 1998 more than 45 percent of the globe’s people had to live on incomes averaging $2 a day or less. Meanwhile, the richest one- fifth of the world’s population has 85 percent of the global GNP. And the gap between rich and poor is widening.

- In 2002, the Food and Agriculture Organization of the UN estimated that 75 percent of the world’s oceanic fisheries were fished at or beyond capacity. The North Atlantic cod fishery, fished sustainably for hundreds of years, has collapsed, and the species may have been pushed to biological extinction.

- The first global assessment of soil loss, based on studies of hundreds of experts, found that 38 percent, or nearly 1.4 billion acres, of currently used agricultural land has been degraded.

- Fifty-four nations experienced declines in per capita GDP for more than a decade during the period 1990–2001.

These are symptoms of a world in overshoot, where we are drawing on the world’s resources faster than they can be restored, and we are releasing wastes and pollutants faster than the Earth can absorb them or render them harmless. They are leading us toward global environmental and economic collapse—but there may still be time to address these problems and soften their impact.

FINAL WARNING LIMITS TO GROWTH