Top Stories

New Coal Plants Rise in 2015 Despite Falling Consumption

Old coal plants are increasingly lying dormant, yet new ones keep getting built, according to a new report. The analysis by CoalSwarm, which includes researchers from Greenpeace and the Sierra Club, looks at the state of global coal over the last year. Their findings highlight a disconnect between the recent reductions in demand for coal, and the hundreds of gigawatts of new capacity that developers want to build in the future. Dormant plants Enthusiasm for burning coal has waned in recent years due to climate regulations and efforts to combat air pollution. In 2014, falling demand for coal in China meant that consumption fell for the first time, dipping by around 0.9%. While a relatively small decline, it is in sharp contrast with the annual average growth of 4.2% for the last decade. The trend is expected to have continued during 2015. Beijing recently released its statistics for 2015, […]

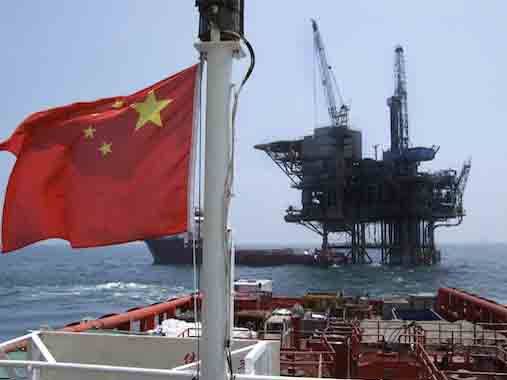

China Oil Giants Take Spending Cuts Deeper as Profits Shrink

After chopping spending by almost one-third to cope with a crash in oil prices and billions in writedowns that sent profits to the weakest since last decade, China’s energy giants are cutting even deeper. (Bloomberg) — After chopping spending by almost one-third to cope with a crash in oil prices and billions in writedowns that sent profits to the weakest since last decade, China’s energy giants are cutting even deeper. PetroChina Co., Cnooc Ltd. and China Petroleum & Chemical Corp., which together produce more crude than any country in OPEC besides Saudi Arabia, will reduce combined capital expenditure by about 8 percent this year, or roughly 29.5 billion yuan ($4.6 billion). That’s after they cut almost 174 billion yuan from spending last year. “The Chinese oil giants will continue to cut,” Qiu Xiaofeng, chief oil analyst with China Galaxy Securities Co., said by phone from Shanghai. “If the oil […]

China Seen Surpassing U.S. as Top Oil Importer This Year: Chart

The crisis engulfing the global steel industry is so severe that one of China’s top producers has warned a new Ice Age has set in as mills confront overcapacity and rising competition that threaten their survival. “In 2015, China experienced a slowdown in economic growth and excess steel capacity, which caused the domestic and overseas steel industry to enter into an ‘Ice Age’,” Angang Steel Co. said after posting a net loss of 4.59 billion yuan ($710 million) for last year. There are severe challenges, fierce competition and difficult survival conditions, it said. Steel demand in China is shrinking for the first time in a generation as growth slows and policy makers seek to steer the economy toward consumption. Faced with declining sales at home, mills in the top producer — which accounts for half of global supply — have shipped record volumes overseas, heightening competition from Europe to […]

OPEC oil output rises in March as Iran, Iraq growth offsets outages

OPEC oil output is rising in March, a Reuters survey found, as higher supply from Iran after the lifting of sanctions and near-record exports from southern Iraq offset maintenance and outages in smaller producers. The survey also found no major change in production in top exporter Saudi Arabia – another sign that Riyadh is serious about freezing output to support prices, which hit a 12-year low near $27 a barrel in January but have since recovered to $40. Producers are meeting on April 17 in Qatar to discuss the plan. “The production freeze has put a floor under the price,” said Carsten Fritsch, analyst at Commerzbank. “We see a risk of a short-term setback if the meeting produces a disappointment.” Supply from the Organization of the Petroleum […]

Oil Trader Andurand, Who Called Slump, Sees Bull Run’s Start

Pierre Andurand, a hedge-fund manager who predicted the oil collapse, said crude is starting a “multi-year bull run” because low prices have curbed supply. Crude futures, currently trading near $40 a barrel, will rebound to $60 to $70 this year and $80 in 2017, the chief investment officer of London-based hedge fund Andurand Capital Management LLP said in a newsletter to investors. A spokesman for the money manager declined to comment. “Large spending cuts are taking a toll on operational maintenance,” according to the newsletter, which was dated February. “After having been in an oversupplied market we expect inventory draws to start in a few months and accelerate quickly.” Oil has slumped about 60 percent since mid-2014, prompting companies to lay off workers, cut investment and cancel projects. While prices have rebounded from a 12-year low reached earlier this year on speculation the surplus is easing as U.S. output […]