Global Oil Demand in 2023

Global oil demand, which includes petroleum products, Natural Gas Liquids (NGLs), refinery gains, and biofuels, will continue to grow in 2023, even in the event of a recession, but at a slower pace than most forecasts. In China, the world’s second-biggest oil consumer, most of the rebound in oil demand in the first half of 2023 will be triggered by the transportation sector, and it will take until the fourth quarter to see the rest of China’s economy recovering. Europe, meanwhile, will experience lackluster economic growth, and we expect a negative year-over-year (YOY) demand growth. The demand growth of oil-producing countries will be affected due to increased import costs, especially food supplies, and declining oil prices. Oil demand growth is now already lower than earlier expectations.

In the US, fears of an economic recession and lower economic growth, accompanied by relatively higher petroleum products prices, will also limit growth in oil demand. Further restrictions are also expected as most developing countries are experiencing depreciating national currencies amid budgetary deficits.

Overview of Forecasts

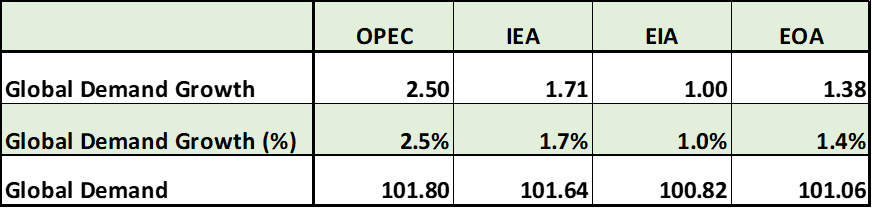

In Table (1) below we list our global oil demand forecast versus those of OPEC, the International Energy Agency (IEA), and the US Energy Information Administration (EIA), assuming no recession takes place this year. Our 2023 demand growth forecast stands at an average of 1.38 million barrels per day (about 1.4%), which is lower than that of OPEC and the IEA, but higher than the EIA’s forecast. Forecasts by major banks and consulting houses are not far different from what is shown in the table below.

OPEC EXPECTS DEMAND WILL EXCEED THE SUPPLY

Table (1)

Global Oil Demand Forecasts: A Comparison (mb/d) *

Source: EIA, 2022, EOA, 2023, IEA, 2022. And OPEC, 2022. * Includes biofuel

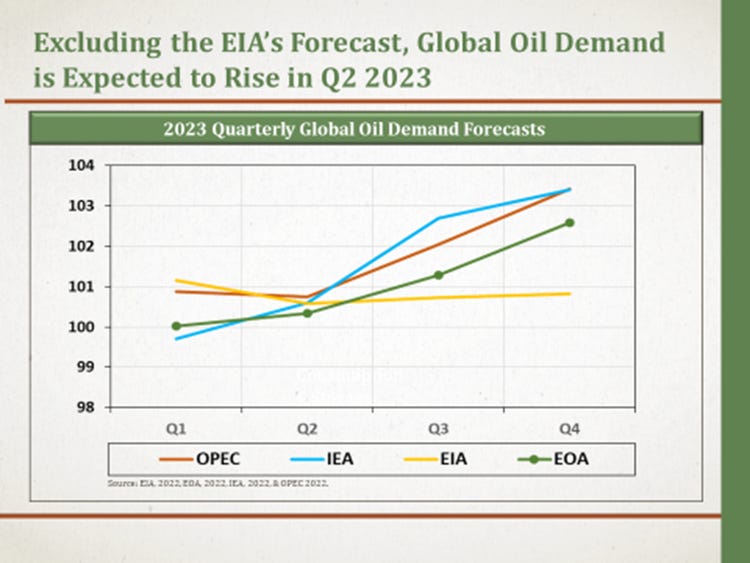

Figure (1) below compares various forecasts on a quarterly basis. The chart mainly focuses on the trends, and we advise against comparing yearly levels given that definitions of oil and liquids differ from one organization to another, and due to the divergent oil demand estimates over the past years. The key takeaway from the chart is that we, as the EOA, expect high demand growth in the second half of 2023 similar to the OPEC and IEA’s forecasts.

Figure (1)

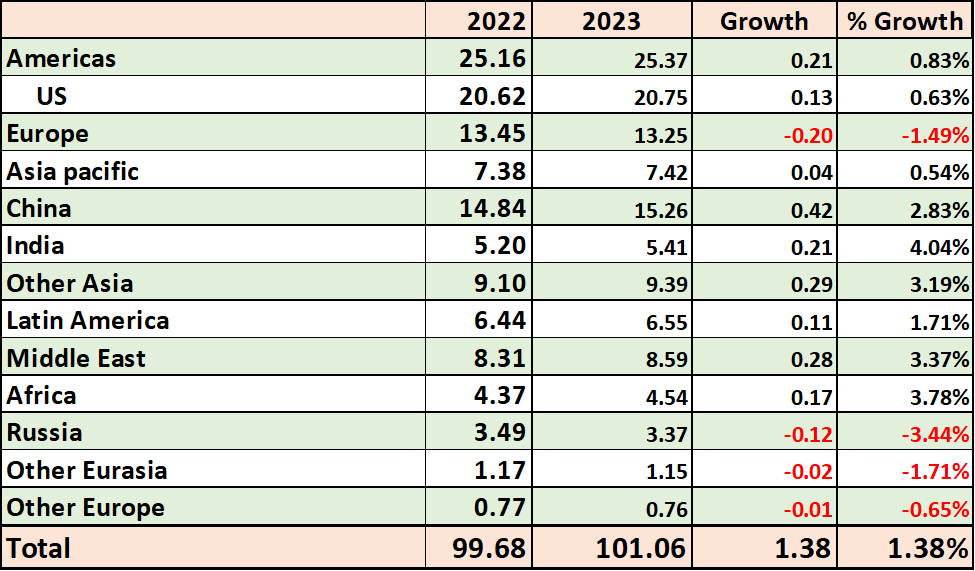

In Table (2) below, we list our global oil demand forecasts by region. We expect a decline in oil demand in Europe, Russia, and other areas, mainly because of worsening economic conditions. Europe’s oil demand is expected to decline by about 200,000 b/d, while Russia’s oil demand is expected to drop by around 120,000 b/d.

Table (2)

Global Oil Demand by Region/Country

Source: EOA, 2023

GLOBAL RECESSION ON HORIZON?

Global Oil Demand in a Recession Scenario

Forecasting global oil demand becomes complicated in a recession scenario. Through applying game theory, we came up with several scenarios, but we will cut to the chase and share with readers our forecast below.

Global oil demand would grow in the event of a mild recession by an average of 820,000 b/d in 2023 relative to the 2022 average. While in the case of a severe recession, demand would drop by about 380,000 b/d. This small decline, however, should not be interpreted as insignificant because it means that a severe recession would wipe out all the demand growth. In other words, a severe recession would lower global oil demand by up to 1.8 mb/d— the expected growth without a recession in addition to the decline year-over-year.

For our forecast in a recession scenario, we took various factors into consideration, including the extent of the recession, the reactions of various groups, including OPEC/OPEC+, banks, investors, and private firms, as well as the impact of a global recession on Russia.

We also downplayed the possibility of political turmoil in any of the oil-producing countries in a recession scenario. History shows that most political turbulences that took place in oil-producing countries in the past occurred during periods of high oil prices and rarely happened during a state of low oil prices.

BIG PICTURE FOR LONG TERM DEMAND

No comments:

Post a Comment