TODAY'S TOP ENERGY HEADLINES

' In the Know, Ahead of Markets, Deciding Wisely...'

February 25, 2022

Editor's Comments

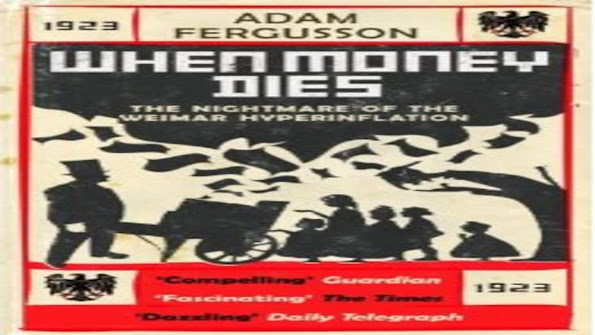

Do not be surprised when the price of gas at the pump is twice the cost of today. Do not be shocked when the price of a new car becomes unaffordable. Nor should you question the food budget when it exceeds half a monthly paycheck. A year from now this may be the new economic normal. An economic normal defined as hyperinflation.

Why now? Many reasons and certainly the war in Ukraine is contributing as Russia provides 10% of global oil production and an estimated 25% of the natural gas used by the EU. Russia is also a major exporter of industrial metals and minerals, as well as wheat.

But it is not just Russia causing the shortages as they have been happening worldwide. Agriculture is obviously being affected by climate change and ecocide while water shortages and rising fertilizer costs are adding to the cost of producing agricultural commodities including livestock.

Signs are everywhere and they are unlikely to reverse as the global population continues its upward path, climate, and ecological conditions worsen, and industrial metal and non-metallic minerals along with fossil fuels move towards exhaustion as predicted by many experts and researchers in 2040-2050.

That said, many leading money managers are shifting their portfolios from stocks, bonds, and currencies to booming commodity prices sectors for safety and higher returns. The shortages are widening in most areas and along with it the prices. Some say over $700 billion is now invested in the asset class - an amount not recorded in over 14 years.

What does this mean for Main Street? Time to adjust your thinking and budgets to the new economic gun in town - Hyperinflation!

Not good...

T A McNeil

CEO Founder

First Financial Insights

- Oil steadies on waning supply worries over Ukraine crisis

- Oil Steadies as U.S. Avoids Harsh Sanctions, Iran Nears Endgame

- Russia Response Could See Oil Burst Through $100

- Shipping Fuel Costs: The Unseen Enemy In The Fight Against Inflation

- Banks Have Spent $1.5 Trillion On Coal Since 2019

- Energy sector methane emissions 70% higher than official figures -IEA

- Antarctic Sea Ice Shrinks to Smallest Surface Area on Record

- Climate Scientists Warn of a ‘Global Wildfire Crisis’

- Saudi Arabia Slams Shortsighted Campaign Against Oil

- Nigeria sues JP Morgan for $1.7 billion over oil deal

- China’s Solar Power Growth to Soar in 2022 on Project Pipeline

- China’s trucked LNG price hits record high, Central Asian gas supply shrinks

- ‘These Waters Are Hot’: U.S. Auction Opens Up Offshore Wind Rush

- White House again contemplates SPR release as oil prices stay above $90/b

- US gas production rebound continues amid bullish growth outlook

- Biden Delays Oil Permits as Gasoline Prices Surge on Ukraine

- Germany freezes Nord Stream 2 gas project as Ukraine crisis deepens

- Biden’s Russian Bond Ban Gives a Jolt to Global Debt Traders

- Germany Says It Can Do Without Russian Gas. That’s a Tall Order

- Airbus to Use A380 Superjumbo as Hydrogen-Powered Test Bed

- How Europeans Are Responding to Exorbitant Gas and Power Bills

- Russian troops in Ukraine spell uncertainty for oil and gas markets

- Russia’s Natural Gas Will Be “Almost Impossible” To Replace

- Airbus and CFM collaborating on hydrogen combustion demonstration program

No comments:

Post a Comment