What Greece, Cyprus, and Puerto Rico Have in Common

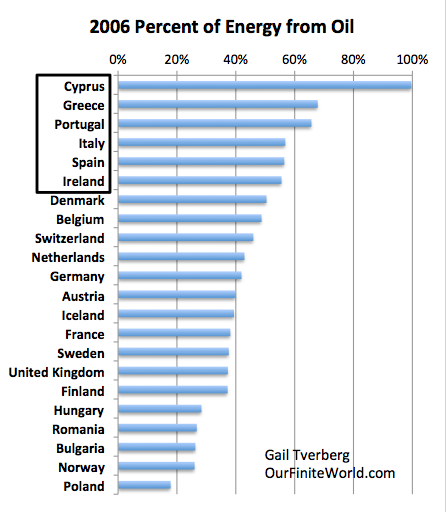

We all know one thing that Greece, Cyprus, and Puerto Rico have in common–severe financial problems. There is something else that they have in common–a high proportion of their energy use is from oil. Figure 1 shows the ratio of oil use to energy use for selected European countries in 2006.

Greece and Cyprus are at the bottom of this chart. The other “PIIGS” countries (Ireland, Spain, Italy, and Portugal) are immediately above Greece. Puerto Rico is not European so is not on Figure 1, but it if were shown on this chart, it would appear between Greece and Cyprus–its oil as a percentage of its energy consumption was 98.4% in 2006. The year 2006 was chosen because it was before the big crash of 2008. The percentages are bit lower now, but the relationship is very similar now.

In my last several crude oil updates, I showed that the “smart money” was betting against crude oil’s rebound that started in March, while the “dumb money” was the main driving force behind it. I have been skeptical of oil’s rebound due to persistently high inventories and the still-sizable long position held by speculators even after last year’s oil crash. Light sweet crude oil sank 7.6 percent during last week’s China-induced commodities rout and because active oil rigs rose for a second straight week after months of declines.

West Texas Intermediate (WTI) crude oil broke down from its wedge patternthat I showed in late-June, and is now sitting just above its key $50 per barrel support level. If WTI crude breaks decisively below its $50 support level, a resumption of the 2014 oil bear market is quite possible. WTI crude may be forming a flag pattern that could indicate further declines if broken to the downside.

Oil Imports Have Energy Poor Greece In A Stranglehold

Oil Imports Have Energy Poor Greece In A Stranglehold

After several years, several months, several weeks and several days of crisis, it looks like things are about to come to a head for Greece and its banks. It becomes easier to understand exactly what GREXIT may mean for the Greek people. What happens when the banks and the government completely run out of money?

Greece has some indigenous coal production (lignite) but no oil or gas to speak of which means that all oil and gas are imported (Figure 1). This is linked to a structural trade deficit that contributes to the country’s dependency on debt. If Greece runs out of Euros, will it be able to buy oil and gas on the international markets? Greece held 90 days of oil stocks in 2010 [2]. Once that is gone then the tourist industry may collapse?

Carl Icahn Believes “There Really Is A Bubble Brewing”

Billionaire investor Carl Icahn spoke with FOX Business Network’s (FBN) Neil Cavuto and Trish Regan about the economy, saying “I believe that there really is a bubble brewing.” He went on to say that we are in “unchartered territory,” with historically low interest rates, and “a market that’s going up artificially,” which “could be very destructive to our markets and our economy.” When asked about what the Federal Reserve should do, Icahn said, “stop worrying what the markets will do,” and “start raising rates right now.” He went on to say that the “Fed is really pandering to a lot of these guys on Wall Street that they really shouldn’t be pandering to.” Regarding whether he’d take the role of Treasury Secretary, as Donald Trump suggested,” Icahn said, “I guess I would not. I sleep too late.”

Two days of high-stakes negotiations between the finance ministers of the currency bloc resulted in a four-page document that included controversial German elements leaked on Saturday. Those measures included Greece leaving the euro temporarily by taking a “time-out” from the currency bloc if it refuses terms for talks on the new bailout or, in the event of agreement, that Greece sets aside €50bn worth of assets as collateral for new loans and for eventual privatisation. Both passages, however, did not enjoy a consensus among eurozone leaders.

What is not an illusion is the extreme trouble many EU countries are in. Besides Greece, Spain and Italy are deep in debt. Smith contends, “Spain’s debt is a trillion euros. Italy is over a trillion euros in debt. We are talking fairly serious money here.”

What is not an illusion is the extreme trouble many EU countries are in. Besides Greece, Spain and Italy are deep in debt. Smith contends, “Spain’s debt is a trillion euros. Italy is over a trillion euros in debt. We are talking fairly serious money here.”

China’s market is also shaped by the heavy hand of the government, which makes decisions about what companies can list shares, when to promote stock rallies and, now, how to intervene when prices plummet. The government, in other words, views the market as a policy instrument, a mechanism to fulfill its political and economic goals. The result can be a volatile market that swings from boom to bust.