Top Stories

Turkey-Russia Rapprochement Spells Bad News for Azerbaijan

Morgan Stanley: Oil To Fall To $35 In A Few Weeks

Oil Tanker Morgan Stanley’s Adam Longson has been one of the most bearish sell-side analysts on oil, and overnight he confirmed he isn’t going to change his opinion any time soon, and instead warns that while “a profit taking and short covering bounce in oil late in the week has led some to declare that the troubles are behind us” he believes that “very little has been addressed fundamentally to correct these problems. Greater headwinds lay ahead, especially for crude oil. In fact, we would argue that recent price action and developments may have exacerbated the situation.” Putting a number to his call: oil will slide to $35 in the next 1-3 months. The key point in Longson’s latest note is a simple, and recurring one: “Fundamental Oil Issues Have Not Been Addressed” and that “Physical market stress due to fundamental headwinds is still ahead.” This is what he […]

The World’s Energy Engine Is Slowing

China’s daily crude imports drop to lowest in six months Coal, natural gas imports slip in July from previous month China’s imports of crude oil, coal and natural gas slowed in July, offering no solace for producers hoping demand from the world’s largest energy consumer may help mop up global gluts of the fuels. The nation imported about 7.35 million barrels a day last month, the slowest pace since January, according to data Monday from the General Administration of Customs. Inbound shipments of coal slipped 2.5 percent from June, while natural gas slumped more than 13 percent. The July data reflects sluggish economic growth in the world’s second-largest economy and contrasts with the country’s rising energy imports in the first six months, which added some support to global prices. During that period, crude purchases jumped 14 percent and coal rose 8.2 percent as domestic users turned to cheaper overseas […]

Venezuela Seen Staving Off Default Again Even as Crisis Worsens

PDVSA to pay $4.1 billion due by year-end, Aberdeen says Goldman Sachs says country has now fallen into a ‘depression’ Even as Venezuela’s economic collapse deepens, the nation has a good chance of getting through another year without defaulting on its bonds . That’s the conclusion of money managers including Aberdeen Asset Management and Wall Street banks like JPMorgan Chase & Co. Start your day with what’s moving markets. Get our markets daily newsletter. Business Your guide to the most important business stories of the day, every day. You will now receive the Business newsletter Politics The latest political news, analysis, charts, and dispatches from the campaign trail. You will now receive the Politics newsletter Pursuits The best from Bloomberg on style, food and travel. Without opening 50 tabs. You will now receive the Pursuits newsletter Game Plan The school, work and life hacks you need to get ahead. […]

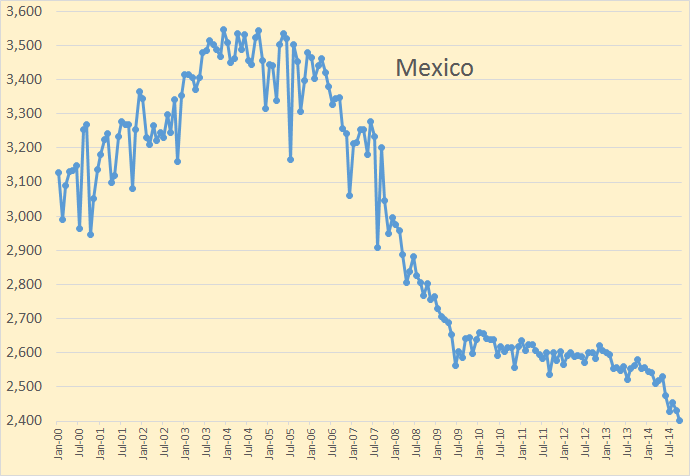

Can Mexico Reverse Its Steep Output Decline?

The petroleum industry in Mexico dates back over a century to 1901 where the commercial production of crude oil began. Since then, both Great-Britain and the United States played major roles in helping the country grow to being the world’s second largest producer of oil in the 1920s. The Mexican revolution caused major political unrest, and led to the nationalization of all hydrocarbon resources and the creation of the national oil company, PEMEX, in 1938.

Today, approximately 50 percent of oil produced in Mexico is heavy crude, and Mexico is now the eighth largest oil producer in the world, exporting $18.8 billion worth of crude oil in 2015. PEMEX produced about 2.23 Mbbl/day in February 2016, down from its peak of 3.4 Mbbl/day in 2004, of which about 76 percent of production comes from offshore fields. The Northeast region consists of the Ku-Maloob-Zaap (KMZ) and Cantarell field, which contribute […]

Today, approximately 50 percent of oil produced in Mexico is heavy crude, and Mexico is now the eighth largest oil producer in the world, exporting $18.8 billion worth of crude oil in 2015. PEMEX produced about 2.23 Mbbl/day in February 2016, down from its peak of 3.4 Mbbl/day in 2004, of which about 76 percent of production comes from offshore fields. The Northeast region consists of the Ku-Maloob-Zaap (KMZ) and Cantarell field, which contribute […]