" oil prices in the wake of the attacks highlights the importance of Strait of Hormuz as a global oil artery"

Middle East Tanker Insurance Rates Soar 10-Fold

Insurance rates for tankers going through the Strait of Hormuz have

skyrocketed tenfold in the two months since the first attacks on tankers

off the coast of the UAE, CNBC reports, quoting the chief executive of a

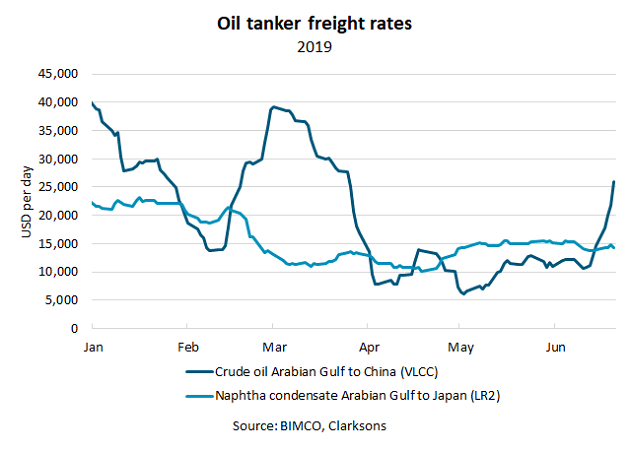

shipping company. The news could reinforce anticipation of higher oil

prices, not because of fundamental factors but because of insurance

rates.

The first link in a chain of events that may send prices higher took place in late May, when Middle Eastern media reported attacks

on four tankers off the coast of the port of Fujairah, in the Persian

Gulf and close to the Strait of Hormuz. Then, about two weeks later,

another attack was reported,

this time in the Gulf of Oman, right out of the Strait of Hormuz.

Finally, Iran shot down a U.S. drone claiming it was flying over its

territory.

After the U.S. blamed both tanker attacks on Iran, the

drone incident was seen by many as the last straw before open military

confrontation. This has not yet materialized, but oil prices spiked

after both attacks and the drone shoot-down and reports about insurers

hiking their tanker premiums for Strait of Hormuz-passing vessels

multiplied.

LEARN MORE

CAN DIPLOMACY WORK?