Top Stories

Why Did China Grossly Overpay For A Utility In Brazil?

China Utlilties Chinese state energy companies are huge by international standards. Their government wants them to ex-pand overseas and they seem indifferent to conventional standards of profitability. This makes them for-midable competitors. And the fact that they can borrow from government-owned banks at attractive in-terest rates lessen their competitive advantage. The State Grid of China, for instance, has $466 billion in assets (yes, we checked that number to make sure we had the decimal in the right place). By comparison one of the U.S.’s largest utilities, Southern Company, has “only” $78 billion of assets. China’s State Grid just made a bid to buy a controlling position in one of Brazil’s biggest electric companies, CPFL Energia, with the bulk of its assets in the industrial state of São Paulo. The offer itself is not the big news. This Chinese firm already owns transmission assets in Brazil. Nor should it be […]

U.S. gasoline oversupply pushes crude oil prices lower

U.S. gasoline stocks remain stubbornly high despite record demand from motorists, a situation that will probably force refiners to cut crude processing over the next few months and prioritize production of diesel. The prospect of reduced refinery processing rates has intensified the downward pressure on crude oil prices in recent days. U.S. gasoline stockpiles have been running above last year’s level since January but the year-on-year build-up has increased rather than lessened as the summer driving season arrived ( tmsnrt.rs/29jUrGi ). Gasoline stockpiles hit a seasonal record 239 million barrels on June 24, an increase of 22 million barrels (10 percent) compared with the previous year, according to data from the U.S. Energy Information Administration. The year-on-year stock build […]

Canada’s Oil-Sands Industry Girds for Leaner Times

As the Canadian oil-sands hub of Fort McMurray, Alberta, battles to rebuild after wildfires that ripped through in May, the industry that made it a boomtown is contemplating the end of an era of rapid growth. The wildfires, which roiled global crude markets by temporarily shutting off production of at least a million barrels of oil a day, added to the mounting woes of Canada’s oil-sands producers. High costs, tighter regulations, and tougher competition from shale oil have turned the industry into one of the biggest casualties of a two-year-old swoon in oil prices. “A lot of plans that were based on triple-digit oil prices in the $100s [per barrel] are having to be adjusted in this environment,” said Murray Edwards, chairman of Canadian Natural Resources Ltd. CNQ 1.71 % “All of us are […]

Oil Industry Faces Huge Worker Shortage

Roughnecks at work The rig count has rebounded from the lows seen in late May, a small indication that oil companies in the U.S. could begin drilling anew. Shale drilling is a short-cycle prospect, requiring only a few weeks to drill and bring a well online. Because of this, the collective U.S. shale industry has been likened to the new “swing producer”: low oil prices force quick cutbacks but higher prices trigger new supplies. In essence, shale could balance the market in the way OPEC used to. While that notion was always a bit simplistic, one reason that U.S. shale production won’t necessarily spring into action in short order is because the people and equipment that were sidelined over the past two years can’t come back at a moment’s notice. Oilfield service companies have gutted their payrolls and warm or cold stacked rigs and equipment (temporarily or more permanently […]

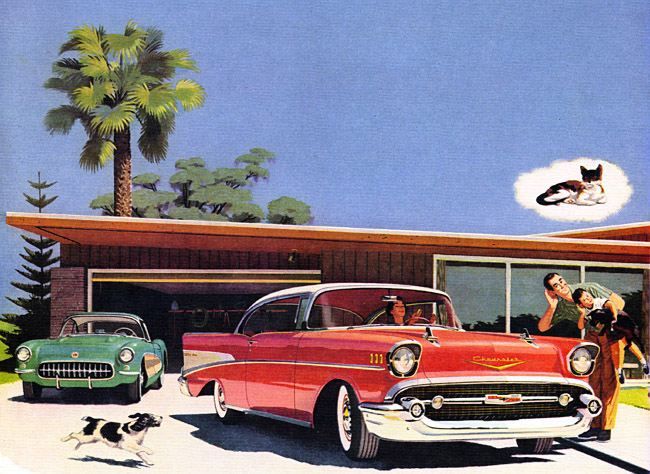

Is the car culture dying?

Few technological breakthroughs have had the social and economic impact of the automobile. It changed America’s geography, spawning suburbs, shopping malls and sprawl as far as the eye could see. It redefined how we work and play, from the daily commute to the weekend trek to the beach. It expanded the heavy industry — steel-making, car production — that made the Midwest the economy’s epicenter for decades. And, finally but not least, the car became the quintessential symbol of American mobility, status and independence. Now there are signs that the car and its many offshoots (SUVs, pickup trucks) are losing their grip on the American psyche and pocketbook. The car culture may be dying or, at any rate, slumping into a prolonged era of eclipse. The only question is whether the signs […]