Top Stories

Why Oil Prices Might Never Recover

Two years into the global oil-price collapse, it seems unlikely that prices will return to sustained levels above $70 per barrel any time soon or perhaps, ever. That is because the global economy is exhausted. The current oil-price rally is over as I predicted several months ago and prices are heading toward $40 per barrel. Oil has been re-valued to affordable levels based on the real value of money. The market now accepts the erroneous producer claims of profitability below the cost of production and has adjusted expectations accordingly. Be careful of what you ask for. Meanwhile, a global uprising is unfolding. The U.K. vote to exit the European Union is part of it. So is the Trump presidential candidacy in the U.S. and the re-run of the presidential election in Austria. Radical Islam and the Arab Spring were precursors. People want to throw out the elites who led […]

Oil Producers Prepare for Second-Half Slump as Rally Sputters

Drillers have increased bets on falling prices by 29 percent Prices have fallen 10 percent since reaching 2016 high in June Oil producers aren’t betting on the rally. After surviving two years of low prices, they’re gearing up for a third by buying protection against a renewed downturn. Laredo Petroleum Inc. said July 14 that it hedged more than two million barrels of 2017 output earlier this month. Drillers have increased bets on falling prices by 29 percent this year. Oil Prices Crude has declined more than 10 percent since hitting a 2016 peak in early June, stoking fears of another second-half slump. It was July that broke the back of last year’s bull-run, with oil plummeting 21 percent. The prospect of a repeat has drillers doing everything they can to raise cash, from selling stocks and bonds to adding fresh hedges. “The producers have sold the hell out […]

Saudi Arabia Plans Shipbuilding Complex to Support Oil Exports

Saudi Arabia will build a maritime complex on its east coast, with shipbuilding capability, to provide sufficient capacity for exporting oil, Energy Minister Khalid Al-Falih said Sunday. The country, the world’s largest oil-producing nation, eventually will have a shipping fleet that will match its oil capabilities, Al-Falih said in Riyadh. Saudi Arabian Oil Co., or Aramco, will need more tankers to meet global demand, he told reporters. Oil prices have rebounded more than 70 percent from the 12-year low reached earlier this year as a Saudi Arabian-led OPEC strategy to pressure rivals with lower prices slowly eliminates a surplus in global supply. Al-Falih told the Houston Chronicle newspaper in June that the glut was over, an assessment shared by the International Energy Agency, which said on June 14 that the crude market will be balanced in the second half of 2016. The Organization of Petroleum Exporting Countries expects demand […]

China Oil, Coal Buying Seen Sustained as Local Supplies Drop

Falling oil output, higher refining may support crude imports Coal imports may continue to rise to fill gap in supply China’s appetite for foreign energy is as strong as ever. Growing demand from oil refiners and the continued filling of strategic crude reserves in the face of domestic production declines will support crude buying by the world’s second-largest consumer, according to analysts from Energy Aspects Ltd. and ICIS China. Coal imports will continue to rise to help fill a supply gap left by a mining slowdown. “Crude buying will remain substantial in the second half” of the year, Michal Meidan, an analyst at Energy Aspects, said by e-mail. “This is because domestic output is declining and there will also be SPR fills of around 50 million to 60 million barrels.” Demand from the world’s largest energy consumer is a bright spot for energy markets hammered by oversupply. Oil has […]

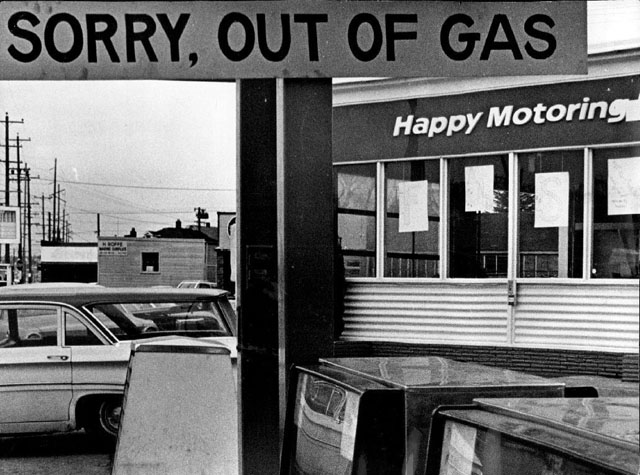

Independent US oil producers seek ban on crude imports

Months after the US energy industry triumphed in overturning an oil export ban, a group of independent producers wants to take policy one step further and curtail crude imports. The Panhandle Import Reduction Initiative has begun campaigning for quotas on all foreign suppliers excluding Canada and Mexico. Its founders, Texas and New Mexico oilmen, said Saudi Arabia is trying to crush their industry and it’s time to fight back. “It’s not fair and it’s not free when a country is trying to drive individual producers in the United States out of business,” said Tom Cambridge, an oil producer in Amarillo, Texas. “What we would like to do is limit imports.” The push comes two years after crude first dropped below $100 a barrel. In late 2014 Saudi Arabia and other Opec members resolved to keep taps open despite falling prices, hastening bankruptcy for dozens of US producers.